- Re:VITALIZE

- Posts

- Personal Update from Gale!

Personal Update from Gale!

Hello 👋

Welcome to the 119th edition of the Re:VITALIZE Newsletter for founders and friends.

See below for a big update from Gale!!

New readers can subscribe here. ✨

Gale’s Thoughts on the Market & Investing

The first Re:VITALIZE newsletter of the year comes to you with my thoughts being more of a personal update. I am going to announce this on LinkedIn next week and wanted to let you know first!

After 14 years leading two venture capital firms, I've decided to begin my exit as an active investor in VC. This means I will not raise a third fund for VITALIZE. There were a number of factors that influenced this decision, including an honest assessment of how many portfolio companies one person can truly manage and support over the life of a VC career. Because even though I step back from raising a fund and actively investing, I will have many more years to complete the work I have already started.

In 2018, I raised Fund I ($16M) and deployed that across 26 companies, 20 of which are still active today. In 2021, Fund II ($23M) launched, and I committed to our final deal in November, which brings the total companies to 32, 31 of which are still operating. As many of you know, I've also been very interested in increasing access to the angel & VC asset classes. As a result, we launched VITALIZE Angels which was active for three years and invested in 21 pre-seed companies, 16 of which are still in business. Add in a handful of SPVs over the years, and VITALIZE has ~70 portfolio companies to support through exit.

My time will transition from fundraising and doing new deals to assisting portfolio companies and ensuring I do right by my investors and founders. Now that I’m in the "harvest period" of VITALIZE’s second fund, my time is mostly spent helping portfolio founders with general strategy and fundraising advice, as well as handling all administrative items for the firm. Now that I have some time to think, I look forward to becoming smarter about exit strategy and tactics that run the full spectrum -- IPO, large M&A, small M&A, PE roll-up, and acquihire.

It has been a true honor to invest in all of our founders and to partner with such a wonderful group of LPs and co-investors. I have loved nearly every minute of the past decade plus. There have been many highs, lows, lessons learned, and friendships made.

Now that I am no longer working 80 hour weeks to raise money and do new deals on top of fund management and portfolio support, I do have a few other interesting irons in the fire…

I recently launched a 501c3 dog rescue through which I hope to re-imagine access to spay and neuter in rural areas of the US. To do this, I want to create a steady stream of income to fund this in a meaningful way. As such, I just purchased an 8,000 square foot cabin on 30 wooded acres 35 minutes from downtown Nashville, TN. I am redesigning this into a retreat space with 7 bedrooms and 14 beds. It would be a great offsite location for a startup or executive team. I am giving away a number of weekends over the next six months for friends to use it at no charge (just pay the cleaning fee). If you want to get a group of 10-14 people together to test it, please reach out for more information! You're welcome to follow along with the dog rescue (@galelovesdogs on TikTok & YouTube) and nature resort (@samsonsprings on TikTok & YouTube) if you’re interested.

Thank you again for being a friend of VITALIZE...I could not have done any of this without so much support! I look forward to staying in touch with you via these newsletters which will move to a quarterly cadence. Until next time.

Recent VITALIZE Investments

Jack (Fund II) - Helping applicants apply to more relevant jobs and helping enterprises pinpoint amazing candidates with data & AI.

Work Insights

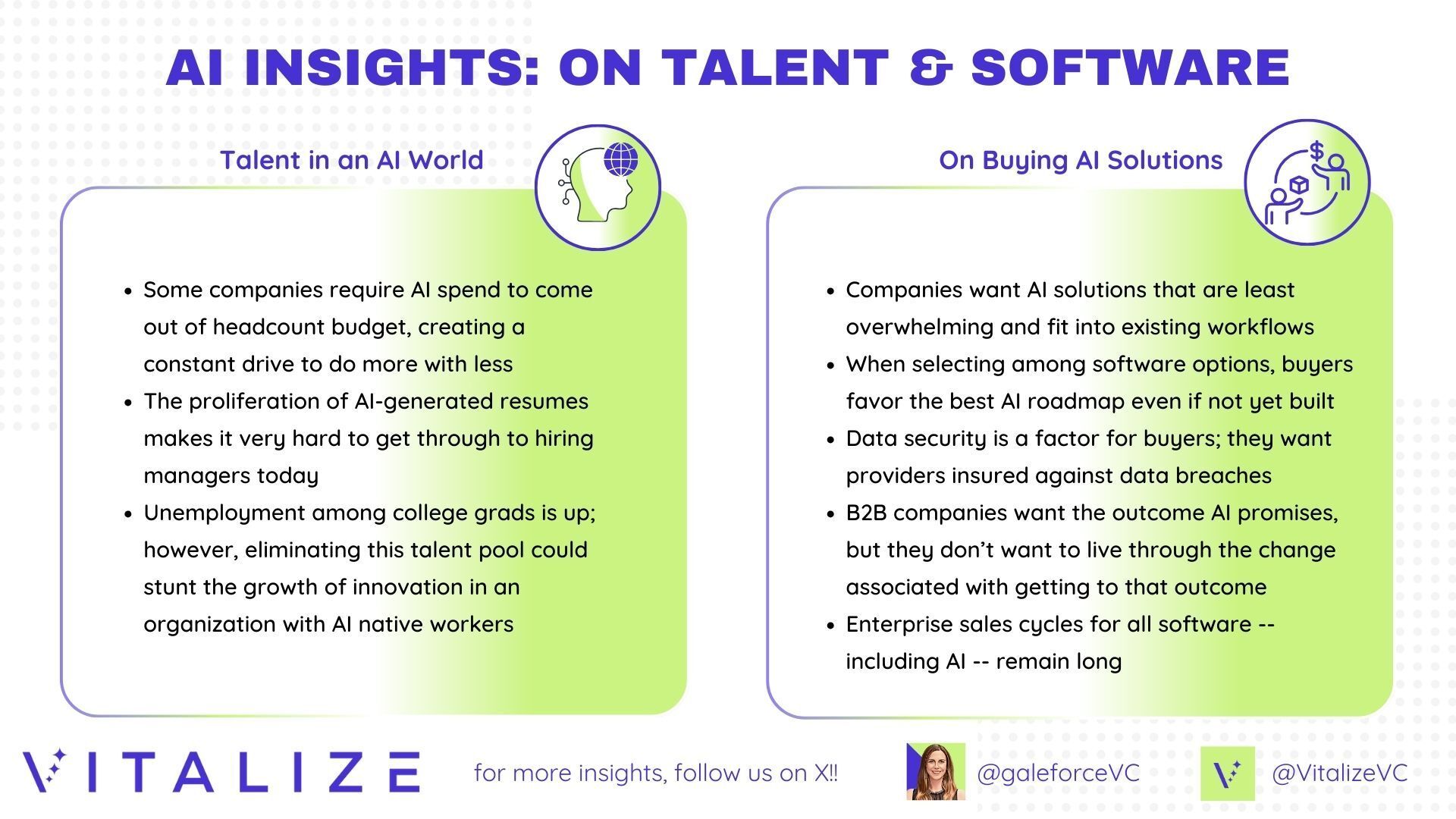

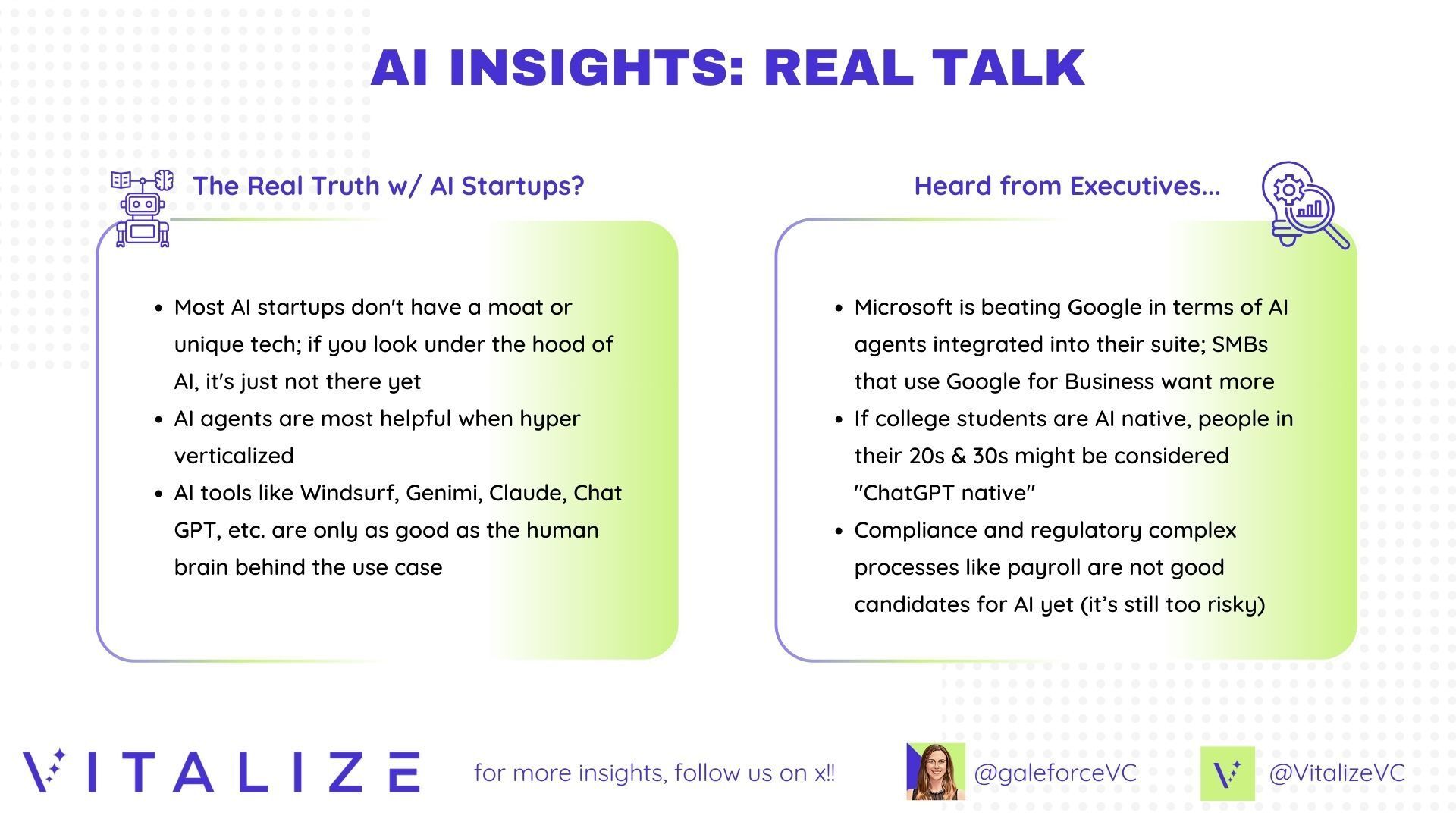

Summary slides from our last session with our team and 50-person expert network:

A VITALIZE Win

Palla (Fund II) was featured in Visa Payments Forum as their flagship partner for Request-a-Remittance / cross-border payments use cases!

Work Insights

Some articles we like on Work Insights:

Agents, robots, and us: Skill partnerships in the age of AI (McKinsey)

9 Future of Work Trends for 2026 (Gartner)

What HR professionals have to say about DEI (HBS)

The Workplace Changes That Will Demand Leadership Focus In 2026 (Forbes)

From digital divide to investment dividend: Why women are the key to a future-proof workforce (WEF)

Our Content Picks for Founders

🥇 Curated Resources

🥈 90-Day Personal Brand Roadmap

🥉 2026 Pre-Seed and Seed Active VC List

Our Content Picks on Investing

🥇 Truth About VC

🥈 Where Breakthroughs Live

🥉 Right Money Right Fit

VITALIZE Portcos in the News

Alembic (Fund I) raised a $145M Series B, which was featured in The Wall Street Journal

MarginEdge (Fund I) has been named an Inc. Magazine Power Partner for 2025

Goodword (Fund II) officially launched and was featured on Upstarts

Goodword’s story and pitch deck were featured in Business Insider

Tembo Health (Fund II) has been selected by the AgeTech Collaborative™ from AARP to showcase its innovation in dementia care at CES 2026

Balloon (VITALIZE Angels) was featured in Forbes, capturing the company’s mission and work

Check out open jobs at VITALIZE portfolio companies

Written by the team at VITALIZE, a venture capital firm investing in U.S.-based B2B software founders innovating in WorkTech. Find us on LinkedIn, X, and YouTube.

This is the 119th edition of the Re:VITALIZE newsletter! ✨